NEWS RELEASE

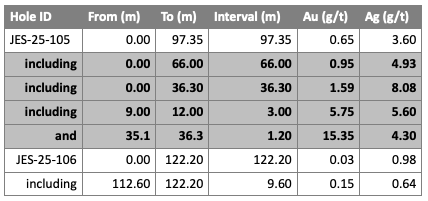

Colibri and Partner - Drilling Returns 1.6 g/t Gold Over 36.6 meters from Surface which Includes High-Grade of 15.2 g/t Gold Over 1.2 meters and 5.8 g/t Gold Over 3 meters at El Pilar Gold Project

March 19, 2025

NEWS RELEASE - Dieppe, NB., March 19th, 2025 - Colibri Resource Corporation (TSX.V:CBI) (OTC:CRUCF) ("Colibri" or the "Company") is pleased to share the assay results from the next two holes drilled in its recent 10 hole diamond drilling program (1,167.5 metres) at the El Pilar Gold & Silver Project in Sonora Mexico. Colibri holds 49% interest of the El Pilar along side its partner Tocvan Ventures, which holds a 51% ownership in this advanced stage exploration project. Tocvan is the operator of the El Pilar.

“We are very happy with the assay results from hole JES-25-105. The hole is highlighted by 36.3 metres of 1.6 g/t gold (starting at surface and is contained within a longer intercept of 66 metres at 1.0 g/t gold). These are extremely favorable grades to encounter when looking for an open pitable gold deposit in Sonora and confirms the site as a source of moderate grade material for the planned 50,000 tonne test mine/bulk sample. We look forward to releasing the results from the remaining 6 holes of this program in due course as the data is received.” commented, Colibri President & CEO Ian McGavney

Tocvan - News Release – March 19th, 2025

Highlights:

- Main Zone Infill Provides Upgrade to Historic Drilling

- 1.6 g/t Au over 36.3 meters from surface within 66 meters of 1.0 g/t Au (Hole JES-25-105)

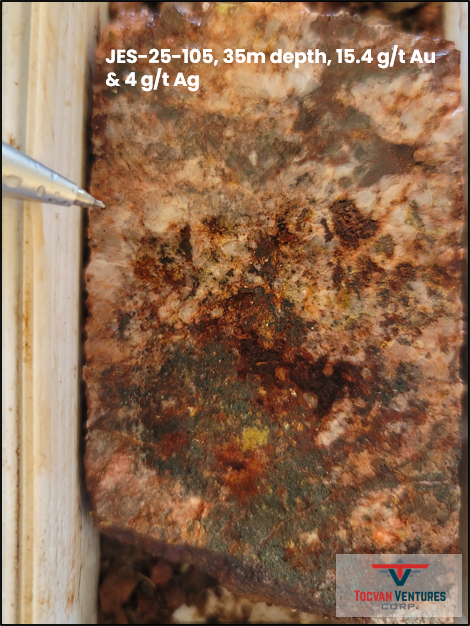

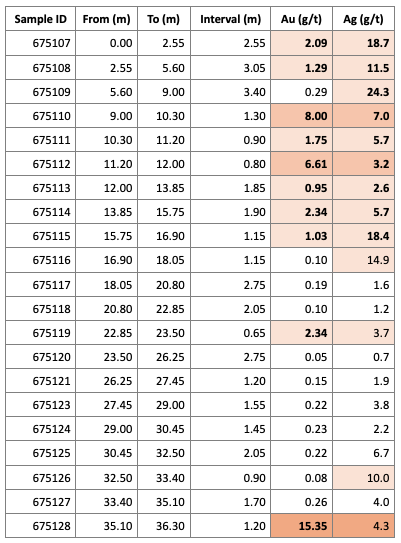

- including 15.2 g/t Au over 1.2 meters, from 35.1 meters depth

- and 5.8 g/t Au over 3.0 meters, from 9.0 meters depth

- Mineralization from surface to 97.4 meters averaging 0.7 g/t Au

- Results Pending for Six Additional Holes

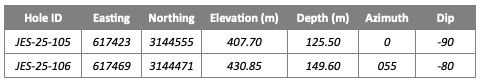

Calgary, Alberta – March 19, 2025 – Tocvan Ventures Corp. (the “Company”) (CSE: TOC; OTCQB: TCVNF; WKN: TV3/A2PE64), is pleased to announce results the latest core drilling at the Gran Pilar Gold Silver Project in mine-friendly Sonora, Mexico. Ten core drillholes totalling 1,167.5 meters were completed earlier this year within the majority owned (51%) Main Zone held in partnership with Colibri Resource Corp. Today’s results are highlighted by 1.6 g/t Au over 36.3 meters from surface, including 15.2 g/t Au over 1.2 and 5.8 g/t Au over 3.0 meters, starting from 9.0 meters vertical depth (JES-25-105). Mineralization correlates with at surface mineralization and lies within a broader anomalous zone drilled that averages 0.7 g/t Au over 97.4 meters. The result from JES-25-105, is a notable improvement from local historic drilling that returned 76.6 meters of 0.5 g/t Au (hole J-7) and 83.8m of 0.5 g/t Au (hole JESP-10), both drilled vertical from surface. To the southeast 100 meters, core hole JES-25-106 returned anomalous mineralization from surface to 122.2 meters depth with the most significant interval returning 3.45 meters of 0.4 g/t Au. Mineralization is known to weaken through this zone. More testing is required to determine the orientation of higher-grade zones known to occur in the area. Results for four core drillholes have now been released, results are pending for the remaining six holes.

“Infill drilling through the Main Zone is identifying precisely where we can source moderate to high-grade ore during pilot and full-scale mining.”

commented, CEO Brodie Sutherland. “Positioned directly below surface trenching, we have a high degree of confidence in the extension of significant mineralization at Pilar. We are excited to evaluate the results for the remaining core holes as they will provide insight towards future development along parallel trends across the property. All information will be fed into our planned maiden resource estimate that will look to outline the resource potential across the Main Zone, an important milestone leading towards unlocking the full property potential.”

Pilar Drill Highlights:

2024 RC Drilling Highlights include (all lengths are drilled thicknesses):

- 42.7m @ 1.0 g/t Au, including 3.1m @ 10.9 g/t Au

- 56.4m @ 1.0 g/t Au, including 3.1m @ 14.7 g/t Au

- 16.8m @ 0.8 g/t Au and 19 g/t Ag

2022 phase 3 diamond drilling highlights include (all lengths are drilled thicknesses):

- 116.9 metres of 1.2 grams per tonne gold, including 10.2 m of 12 g/t Au and 23 g/t Ag;

- 108.9 m of 0.8 g/t Au, including 9.4 m of 7.6 g/t Au and 5 g/t Ag;

- 63.4 m of 0.6 g/t Au and 11 g/t Ag, including 29.9 m of 0.9 g/t Au and 18 g/t Ag;

2021 phase 2 RC drilling highlights include (all lengths are drilled thicknesses):

- 39.7 m of 1.0 g/t Au, including 1.5 m of 14.6 g/t Au;

- 47.7 m of 0.7 g/t Au, including three m of 5.6 g/t Au and 22 g/t Ag;

- 29 m of 0.7 g/t Au;

- 35.1 m of 0.7 g/t Au;

2020 phase 1 RC drilling highlights include (all lengths are drilled thicknesses):

- 94.6 m of 1.6 g/t Au, including 9.2 m of 10.8 g/t Au and 38 g/t Ag;

- 41.2 m of 1.1 g/t Au, including 3.1 m of 6.0 g/t Au and 12 g/t Ag;

- 24.4 m of 2.5 g/t Au and 73 g/t Ag, including 1.5 m of 33.4 g/t Au and 1,090 g/t Ag;

15,000 m of historic core and RC drilling; highlights include:

- 61.0 m of 0.8 g/t Au;

- 21.0 m of 38.3 g/t Au and 38 g/t Ag;

- 13.0 m of 9.6 g/t Au;

- 9.0 m of 10.2 g/t Au and 46 g/t Ag.

Pilar Bulk Sample Summary:

62-per-cent recovery of gold achieved over 46-day leaching period;

Head grade calculated at 1.9 g/t Au and seven g/t Ag; extracted grade calculated at 1.2 g/t Au and 3 g/t Ag;

Bulk sample only included coarse fraction of material;

Fine fraction indicates rapid recovery with agitated leach:

Agitated bottle roll test returned rapid and high recovery results: 80-per-cent recovery of gold and 94-per-cent recovery of silver after rapid 24-hour retention time.

Additional Metallurgical Studies:

Gravity recovery with agitated leach results of five composite samples returned:

95- to 99-per-cent recovery of gold;

73- to 97-per-cent recovery of silver;

Includes the recovery of 99 per cent Au and 73 per cent Ag from drill core composite at 120-metre depth.

Based on management’s strong belief in the project’s potential, the Company is outlining a permitting and operations strategy for a pilot facility at Pilar. The facility would underpin a robust test mine scenario with aims to process up to 50,000 tonnes of material. Timelines and budget are being prepared with the aim of moving forward with the development early in 2025. With gold prices hitting all-time highs, the Company believes the onsite test mine will provide key economic parameters and showcase the mineral potential of the area. In 2023, the Company completed an offsite bulk sample that produced important data showcasing the potential to recover both gold and silver through a variety of methods including heap leach, gravity and agitated leach (see August 22, 2023, news release for more details).

Quality Assurance / Quality Control

Rock and Drill samples were shipped for sample preparation to ALS Limited in Hermosillo, Sonora, Mexico and for analysis at the ALS laboratory in North Vancouver. The ALS Hermosillo and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Gold was analyzed using 50-gram nominal weight fire assay with atomic absorption spectroscopy finish. Over limits for gold (>10 g/t), were analyzed using fire assay with a gravimetric finish. Silver and other elements were analyzed using a four-acid digestion with an ICP finish. Over limit analyses for silver (>100 g/t) were re-assayed using an ore-grade four-acid digestion with ICP-AES finish. Control samples comprising certified reference samples and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s robust quality assurance / quality control protocol.

Brodie A. Sutherland, CEO for Tocvan Ventures Corp. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

About Colibri Resource Corporation:

Colibri is a Canadian-based mineral exploration company listed on the TSX-V (CBI) and is focused on acquiring, exploring, and developing prospective gold & silver properties in Mexico. The Company holds four high potential precious metal projects: 1) 49% Ownership of the Pilar Gold & Silver Project which is believed to hold the potential to be a near term producing mine, 2) 100% of EP Gold Project in the significant Caborca Gold Belt which has delivered highly encouraging exploration results and is surround by Mexico’s second largest major producer of gold on four sides, and 3) two highly prospective interests in the Sierra Madre (Diamante Gold & Silver Project and Jackie Gold & Silver Project.

For more information about all Company projects please visit: www.colibriresource.com.

For information contact:

Ian McGavney

President

CEO and Director

Tel: (506) 383-4274

Email: ianmcgavney@colibriresource.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Notice Regarding Forward-Looking Statements:

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. This news release includes certain “forward-looking statements”. These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management’s expectations. Forward- looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration, project development, reclamation and capital costs of the Company's mineral properties, and the Company’s financial condition and prospects, could differ materially from those currently anticipated in such statements for many reasons such as: changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with the activities of the Company; and other matters discussed in this news release. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. These and other factors should be considered carefully, and readers should not place undue reliance on the Company’s forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws.

Related news releases.