NEWS RELEASE - Dieppe, NB., March 26th, 2025 - Colibri Resource Corporation (TSX.V:CBI) (OTC:CRUCF) ("Colibri" or the "Company") is pleased to share the assay results from the next three holes drilled in its recent 10 hole diamond drilling program (1,167.5 metres) at the El Pilar Gold & Silver Project in Sonora Mexico. Colibri holds 49% interest of the El Pilar along side its partner Tocvan Ventures, which holds 51% ownership in this advanced stage exploration project. Tocvan is the operator of the El Pilar. The final three holes from the program will be announced in due course upon receipt of data from the operator.

“We are pleased to have discovered high grade gold and silver mineralization along the largely untested North Hill Trend, which lies approximately 300 metres away from the Main Zone Trend. The reported 3.0 metre interval of 21.6 g/t gold, 209 g/t silver, 6.71% lead, and 1.58% zinc (starting 8.3m below surface) among other notable gold and silver intervals in hole JES-25-108 provides further substantial evidence that the gold and silver mineralization at the shared El Pilar project could be expanded significantly and create even more meaningful value for our respective shareholders. We will work with our partners to further evaluate this discovery and potentially add material from this area to our planned 50,000 tonne test mine/bulk sample.” commented, Colibri President & CEO Ian McGavney

Tocvan - News Release – March 26th, 2025

Highlights:

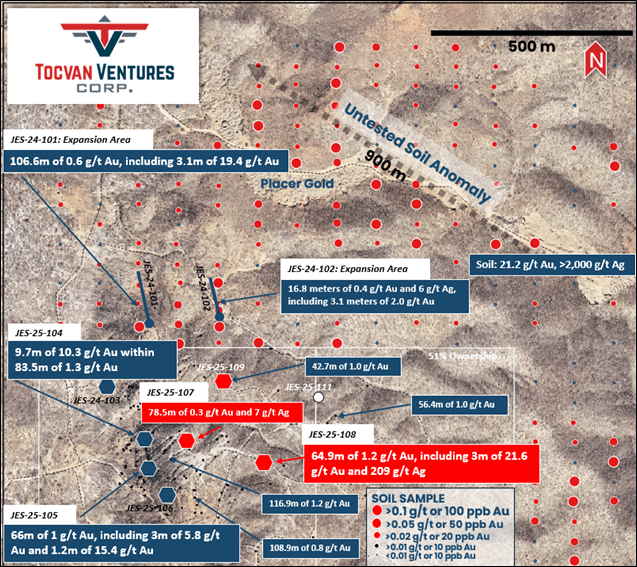

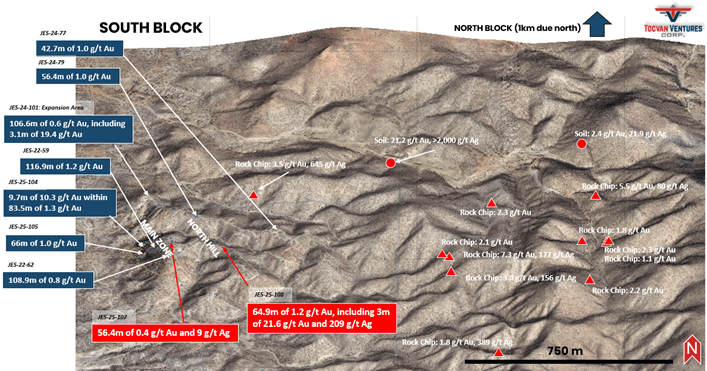

- New Discovery of High-Grade Gold-Silver 300m East of Main Zone, On North Hill Trend

- Highest Grade Interval Ever Outside of Main Zone

- Near Surface Findings Ideal for Follow-up Trenching and Early Mine Development

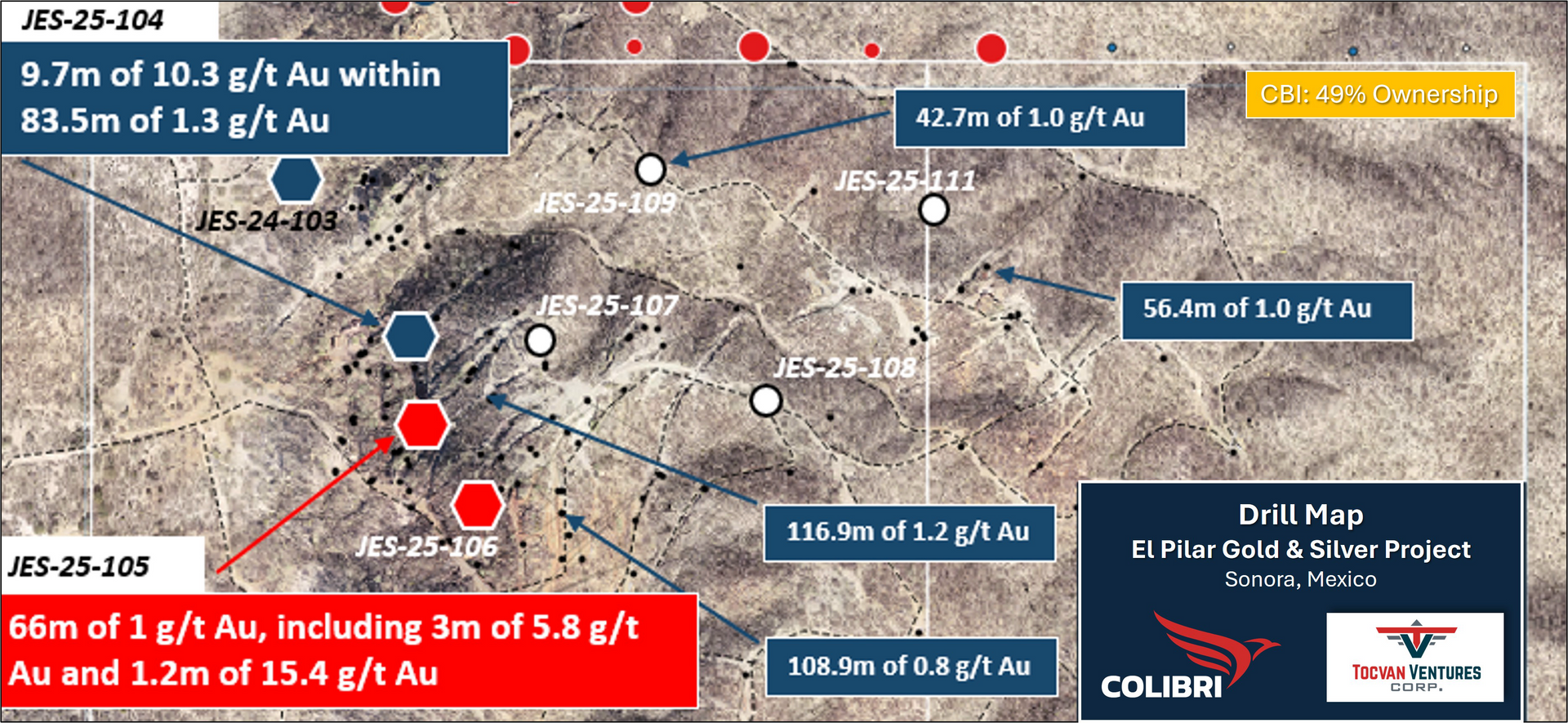

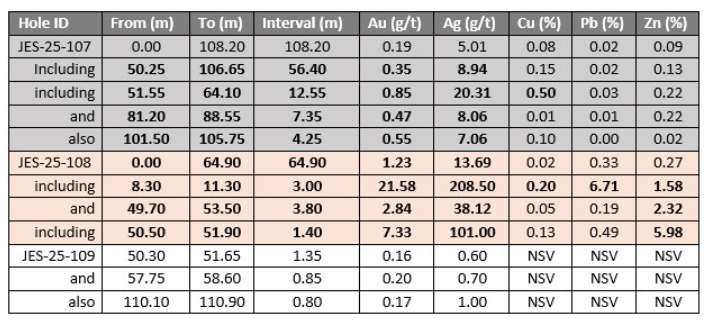

- 1.2 g/t Au and 14 g/t Ag over 64.9 meters, from surface (Hole JES-25-108)

- including 21.6 g/t Au and 209 g/t Ag over 3.0 meters, from 8.3 meters depth

- and 2.8 g/t Au and 38 g/t Ag over 3.8 meters, from 49.7 meters depth

- Also, East Expansion of Main Zone with Hole JES-25-107

- 0.2 g/t Au and 5 g/t Ag over 108.2 meters, from surface

- Including 0.4 g/t Au and 9 g/t Ag over 56.4 meters

- Including 0.9 g/t Au and 20 g/t Ag over 12.6 meters

- And 0.5 g/t Au and 8 g/t Ag over 7.4 meters

- Also, 0.6 g/t Au and 7 g/t Ag over 4.3 meters

- Results Pending for Three Additional Holes

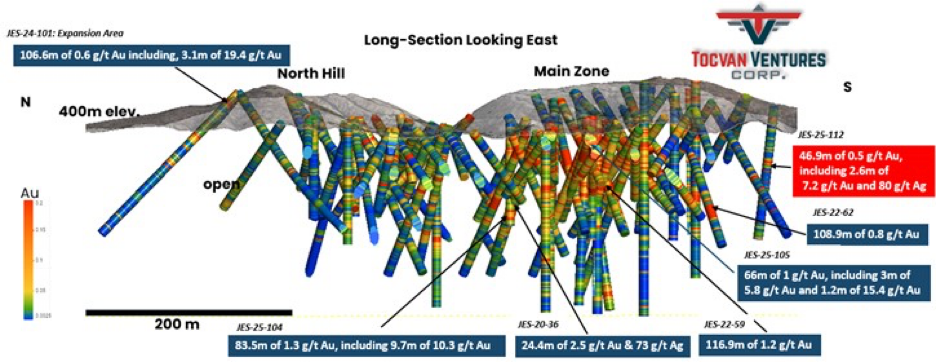

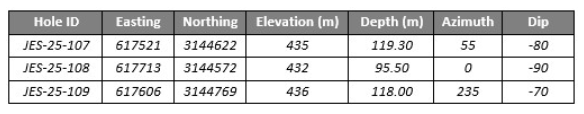

March 26, 2025 / Tocvan Ventures Corp. (the "Company") is pleased to announce results from the latest core drilling at the Gran Pilar Gold Silver Project in mine-friendly Sonora, Mexico. Ten core drillholes totalling 1,167.5 meters were completed earlier this year within the majority owned (51%) Main Zone held in partnership with Colibri Resource Corp. Today's results are highlighted by 21.6 g/t Au, 209 g/t Ag and 6.7% Pb over 3.0 meters, also 2.8 g/t Au, 38 g/t Ag and 2.3% Zn over 3.8 meters within a broader anomalous zone averaging 1.2 g/t Au starting from surface to a vertical depth of 64.9 meters (JES-25-108). The significance of this hole is its location 300 meters east of the Main Zone Trend in line with the North Hill Trend, making it the first discovery of high-grade gold mineralization along the southern end of this corridor. The high-grade looks to be hosted within a highly fractured near-surface fault zone with associated quartz veining. Given the proximity to surface this area will be selected for future trenching to further evaluate the extent of high-grade mineralization for potential pilot mine feed. In addition, hole JES-25-107, 100 meters east of the Main Zone has returned the best values to date on the eastern flank of the Main Zone. The hole returned 108.2 meters of 0.2 g/t Au and 5 g/t Ag from surface, including 12.6 meters of 0.9 g/t Au, 20 g/t Ag and 0.5% Cu; 7.4 meters of 0.5 g/t Au and 8 g/t Ag; and 4.3 meters of 0.6 g/t Au and 7 g/t Ag. Mineralization is hosted within a silicified brecciated andesite with coarse veins of pyrite and chalcopyrite. Hole JES-25-109 only returned a few isolated zones mineralization, core logging shows the hole intersected a large fault zone that separates mineralization hit in past drilling (JES-22-53, and JES-24-79). Results for seven core drillholes have now been released, results are pending for the remaining three holes which have tested the outer extents on mineralization.

"Core drilling has just returned the highest-grade interval ever outside of the Main Zone, located 300 meters away on an emerging trend."

commented, CEO Brodie Sutherland.

"The best part is that it is only meters below the surface allowing us to easily access the area with trenching we have planned in the next phase of exploration. This provides us with another area to source mineralization for potential pilot mine material. Trends like the North Hill remain largely untested and suggest other areas across the broader expansion area hold significant potential for hosting high-grade gold and silver. We look forward to continued drilling across the expansion area to begin targeting additional resource potential."

Pilar Drill Highlights:

2024 RC Drilling Highlights include (all lengths are drilled thicknesses):

- 42.7m @ 1.0 g/t Au, including 3.1m @ 10.9 g/t Au

- 56.4m @ 1.0 g/t Au, including 3.1m @ 14.7 g/t Au

- 16.8m @ 0.8 g/t Au and 19 g/t Ag

2022 phase 3 diamond drilling highlights include (all lengths are drilled thicknesses):

- 116.9 metres of 1.2 grams per tonne gold, including 10.2 m of 12 g/t Au and 23 g/t Ag;

- 108.9 m of 0.8 g/t Au, including 9.4 m of 7.6 g/t Au and 5 g/t Ag;

- 63.4 m of 0.6 g/t Au and 11 g/t Ag, including 29.9 m of 0.9 g/t Au and 18 g/t Ag;

2021 phase 2 RC drilling highlights include (all lengths are drilled thicknesses):

- 39.7 m of 1.0 g/t Au, including 1.5 m of 14.6 g/t Au;

- 47.7 m of 0.7 g/t Au, including three m of 5.6 g/t Au and 22 g/t Ag;

- 29 m of 0.7 g/t Au;

- 35.1 m of 0.7 g/t Au;

2020 phase 1 RC drilling highlights include (all lengths are drilled thicknesses):

- 94.6 m of 1.6 g/t Au, including 9.2 m of 10.8 g/t Au and 38 g/t Ag;

- 41.2 m of 1.1 g/t Au, including 3.1 m of 6.0 g/t Au and 12 g/t Ag;

- 24.4 m of 2.5 g/t Au and 73 g/t Ag, including 1.5 m of 33.4 g/t Au and 1,090 g/t Ag;

15,000 m of historic core and RC drilling; highlights include:

- 61.0 m of 0.8 g/t Au;

- 21.0 m of 38.3 g/t Au and 38 g/t Ag;

- 13.0 m of 9.6 g/t Au;

- 9.0 m of 10.2 g/t Au and 46 g/t Ag.

Pilar Bulk Sample Summary:

62-per-cent recovery of gold achieved over 46-day leaching period;

Head grade calculated at 1.9 g/t Au and seven g/t Ag; extracted grade calculated at 1.2 g/t Au and 3 g/t Ag;

Bulk sample only included coarse fraction of material;

Fine fraction indicates rapid recovery with agitated leach:

Agitated bottle roll test returned rapid and high recovery results: 80-per-cent recovery of gold and 94-per-cent recovery of silver after rapid 24-hour retention time.

Additional Metallurgical Studies:

Gravity recovery with agitated leach results of five composite samples returned:

95- to 99-per-cent recovery of gold;

73- to 97-per-cent recovery of silver;

Includes the recovery of 99 per cent Au and 73 per cent Ag from drill core composite at 120-metre depth.

Based on management’s strong belief in the project’s potential, the Company is outlining a permitting and operations strategy for a pilot facility at Pilar. The facility would underpin a robust test mine scenario with aims to process up to 50,000 tonnes of material. Timelines and budget are being prepared with the aim of moving forward with the development early in 2025. With gold prices hitting all-time highs, the Company believes the onsite test mine will provide key economic parameters and showcase the mineral potential of the area. In 2023, the Company completed an offsite bulk sample that produced important data showcasing the potential to recover both gold and silver through a variety of methods including heap leach, gravity and agitated leach (see August 22, 2023, news release for more details).

Quality Assurance / Quality Control

Rock and Drill samples were shipped for sample preparation to ALS Limited in Hermosillo, Sonora, Mexico and for analysis at the ALS laboratory in North Vancouver. The ALS Hermosillo and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Gold was analyzed using 50-gram nominal weight fire assay with atomic absorption spectroscopy finish. Over limits for gold (>10 g/t), were analyzed using fire assay with a gravimetric finish. Silver and other elements were analyzed using a four-acid digestion with an ICP finish. Over limit analyses for silver (>100 g/t) were re-assayed using an ore-grade four-acid digestion with ICP-AES finish. Control samples comprising certified reference samples and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's robust quality assurance / quality control protocol.

Brodie A. Sutherland, CEO for Tocvan Ventures Corp. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

About Colibri Resource Corporation:

Colibri is a Canadian-based mineral exploration company listed on the TSX-V (CBI) and is focused on acquiring, exploring, and developing prospective gold & silver properties in Mexico. The Company holds four high potential precious metal projects: 1) 49% Ownership of the Pilar Gold & Silver Project which is believed to hold the potential to be a near term producing mine, 2) 100% of EP Gold Project in the significant Caborca Gold Belt which has delivered highly encouraging exploration results and is surround by Mexico’s second largest major producer of gold on four sides, and 3) two highly prospective interests in the Sierra Madre (Diamante Gold & Silver Project and Jackie Gold & Silver Project.

For more information about all Company projects please visit: www.colibriresource.com.

For information contact:

Ian McGavney

President

CEO and Director

Tel: (506) 383-4274

Email: ianmcgavney@colibriresource.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Notice Regarding Forward-Looking Statements:

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. This news release includes certain “forward-looking statements”. These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management’s expectations. Forward- looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration, project development, reclamation and capital costs of the Company's mineral properties, and the Company’s financial condition and prospects, could differ materially from those currently anticipated in such statements for many reasons such as: changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with the activities of the Company; and other matters discussed in this news release. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. These and other factors should be considered carefully, and readers should not place undue reliance on the Company’s forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws.

Related news releases.