NEWS RELEASE - Dieppe, NB., December 19, 2023 - Colibri Resource Corporation (TSX.V:CBI) (OTC:CRUCF) ("Colibri" or the "Company") is very pleased to announce that its recently completed drilling program has resulted in the discovery of a promising new zone of gold mineralization on the Evelyn property at the EP gold project located in the Caborca Gold Belt, NW Sonora. The new area of mineralization has been named West Sahuaro. Drilling highlights of the West Sahuaro includes:

- Gold mineralization was intersected in all 6 holes that tested the target

- Longer intercepts of continuous mineralization include:

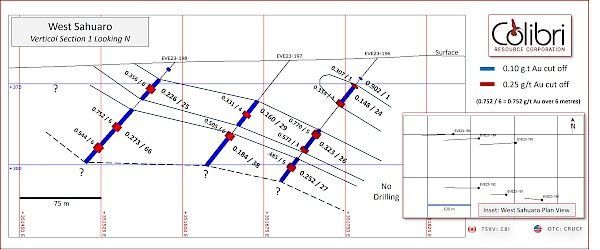

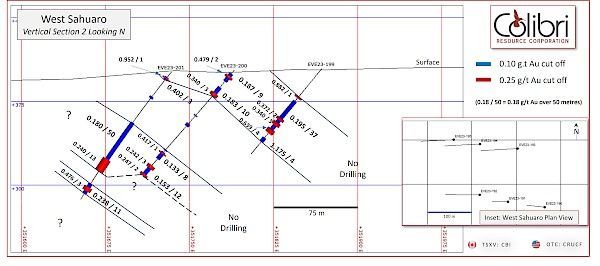

- 23 m intersection length at an average grade of 0.350 g/t Au in hole EVE23-196

- 66 m intersection length at an average grade of 0.273 g/t Au in hole EVE23-198

- Higher grade intercepts included in the longer zones of mineralization include:

- 5 m intersection length at an average grade of 0.770 g/t Au in hole EVE23-196

- 6 m intersection length at an average grade of 0.753 g/t Au in hole EVE23-198

- Of a total of 570 assays completed on 1 m samples, only 7 samples returned Au less than detection limit

- The longer intercepts are apparently continuous in three shallowly east dipping zones with a footprint of approximately 200 metres x 300 metres

- The mineralization is open in all directions and at depth

- Four of the six holes drilled ended in mineralization.

- The deepest intercept is at a vertical depth of approximately 125 m

Ian McGavney, President & CEO of Colibri commented: “Our new discovery at the West Sahuaro Zone is the thickest, most continuous, and highest grade gold mineralization intersected to date on the Evelyn property. We are extremely pleased with these results. The grade of mineralization discovered is approaching the reported production and resource grades at mines and development stage projects in the Caborca Gold Belt. The longer intercepts calculated at a 0.1 g/t Au cutoff grade and the occurrence of pervasively anomalous Au indicates that we have moved into a favourable litho-structural setting on the property. Geophysical and surface mapping indicates that the northwesterly structure that West Sahuaro sits on extends at least 2.5 km in length. We will begin building on this success with further exploration drilling in the West Sahuaro area and by leveraging our exhaustive exploration data set to further target areas along this and other identified mineralized structures.”

Recently Completed Drilling Program

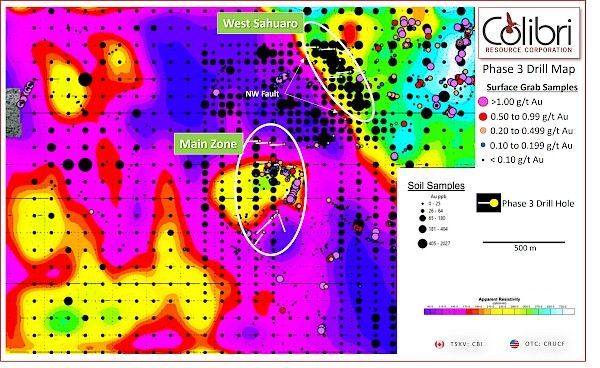

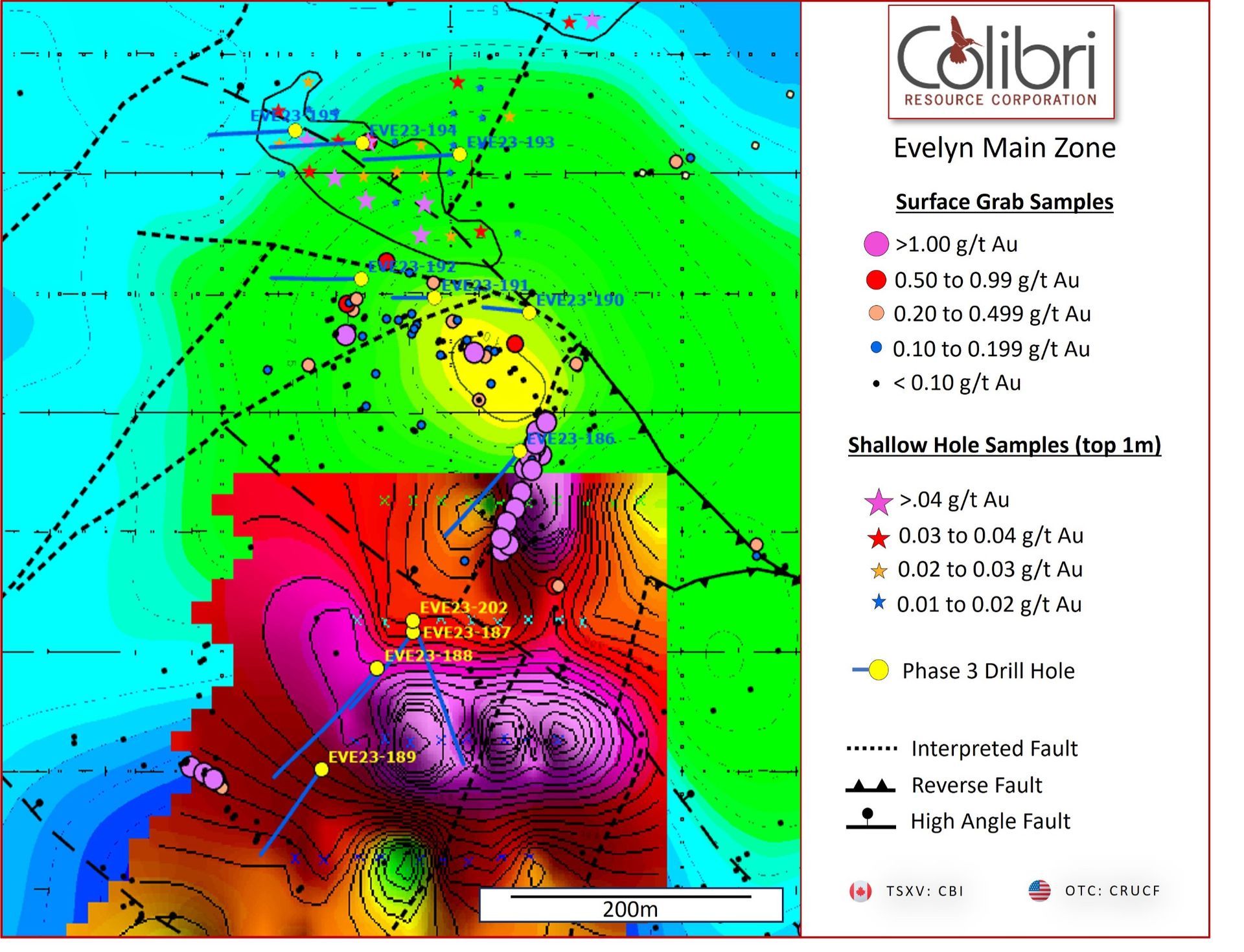

Seventeen reverse circulation (“RC”) drill holes totaling 2,200 metres were completed in two target areas; the West Sahuaro (“WS”) target located in the northeastern part of the Evelyn property immediately west of the El Sahuaro target and the Main Zone area located in the central part of the property (Figure 1).

West Sahuaro – (New Discovery Area)

Six holes (764 m) were drilled on 2-3 hole, E-W, sections spaced at approximately 150 m. All holes intersected significant mineralization consisting of longer intersection lengths calculated at a 0.1 g/t Au cutoff grade and which include higher grade intervals (see table of significant intercepts). Utilizing the 0.1 g/t cutoff grade intervals, the ESW mineralization is consistently interpreted as 3 shallowly east dipping lenses (Figures 2a and 2b below) with a projected to surface extent of approximately 200 m x 300 m. Intersected mineralization is open in all directions, up and down dip and along strike. Four of the six holes ended in mineralization > 0.1 g/t Au. Au assays have been completed on 600 samples and only 7 of these samples returned assays below detection limit.

| Hole ID | From | To | Length | Au g/t |

|---|---|---|---|---|

| EVE23-196 | 25 | 26 | 1 | 0.902 |

| EVE23-196 | 34 | 58 | 24 | 0.148 |

| includes | 34 | 35 | 1 | 0.307 |

| includes | 54 | 58 | 4 | 0.354 |

| EVE23-196 | 88 | 114 | 26 | 0.323 |

| includes | 91 | 96 | 5 | 0.77 |

| includes | 111 | 114 | 3 | 0.572 |

| EVE23-196 | 123 | 150 | 27 | 0.252 |

| includes | 131 | 136 | 5 | 0.485 |

| EVE23-197 | 48 | 77 | 29 | 0.16 |

| includes | 62 | 66 | 4 | 0.331 |

| EVE23-197 | 86 | 124 | 38 | 0.184 |

| includes | 86 | 92 | 6 | 0.505 |

| EVE23-198 | 7 | 10 | 3 | 0.168 |

| EVE23-198 | 21 | 46 | 25 | 0.226 |

| includes | 23 | 24 | 1 | 1.225 |

| includes | 30 | 36 | 6 | 0.356 |

| which includes | 32 | 35 | 3 | 0.496 |

| EVE23-198 | 58 | 124 | 66 | 0.273 |

| includes | 77 | 83 | 6 | 0.752 |

| includes | 102 | 109 | 6 | 0.544 |

| EVE23-199 | 33 | 34 | 1 | 0.882 |

| EVE23-199 | 38 | 75 | 37 | 0.195 |

| includes | 58 | 60 | 2 | 0.372 |

| includes | 63 | 66 | 3 | 0.34 |

| includes | 71 | 75 | 4 | 0.639 |

| EVE23-199 | 81 | 85 | 4 | 1.175 |

| includes | 83 | 85 | 2 | 2.27 |

| EVE23-200 | 4 | 13 | 9 | 0.187 |

Table 1: West El Sahuaro Significant Drill Assays

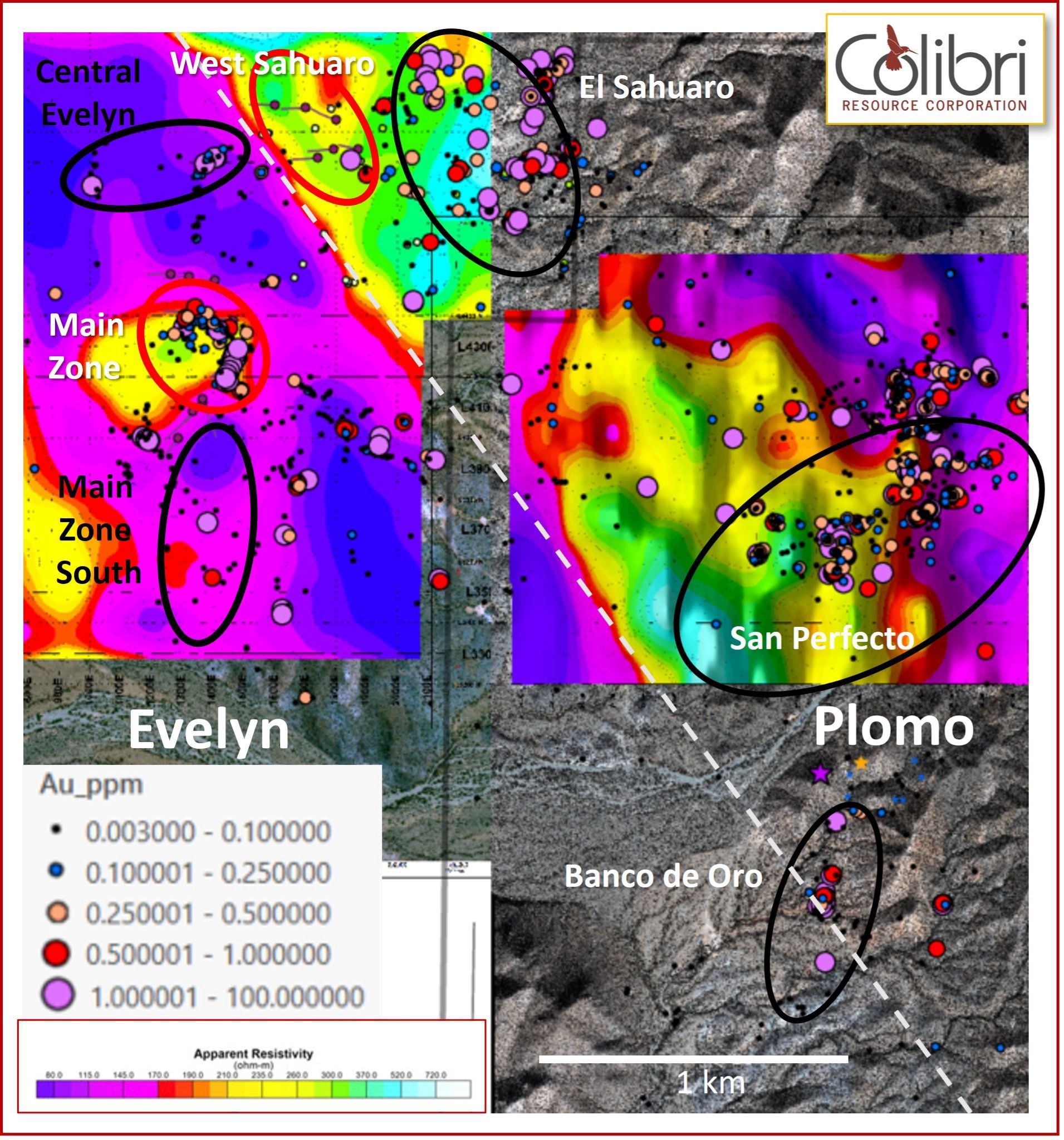

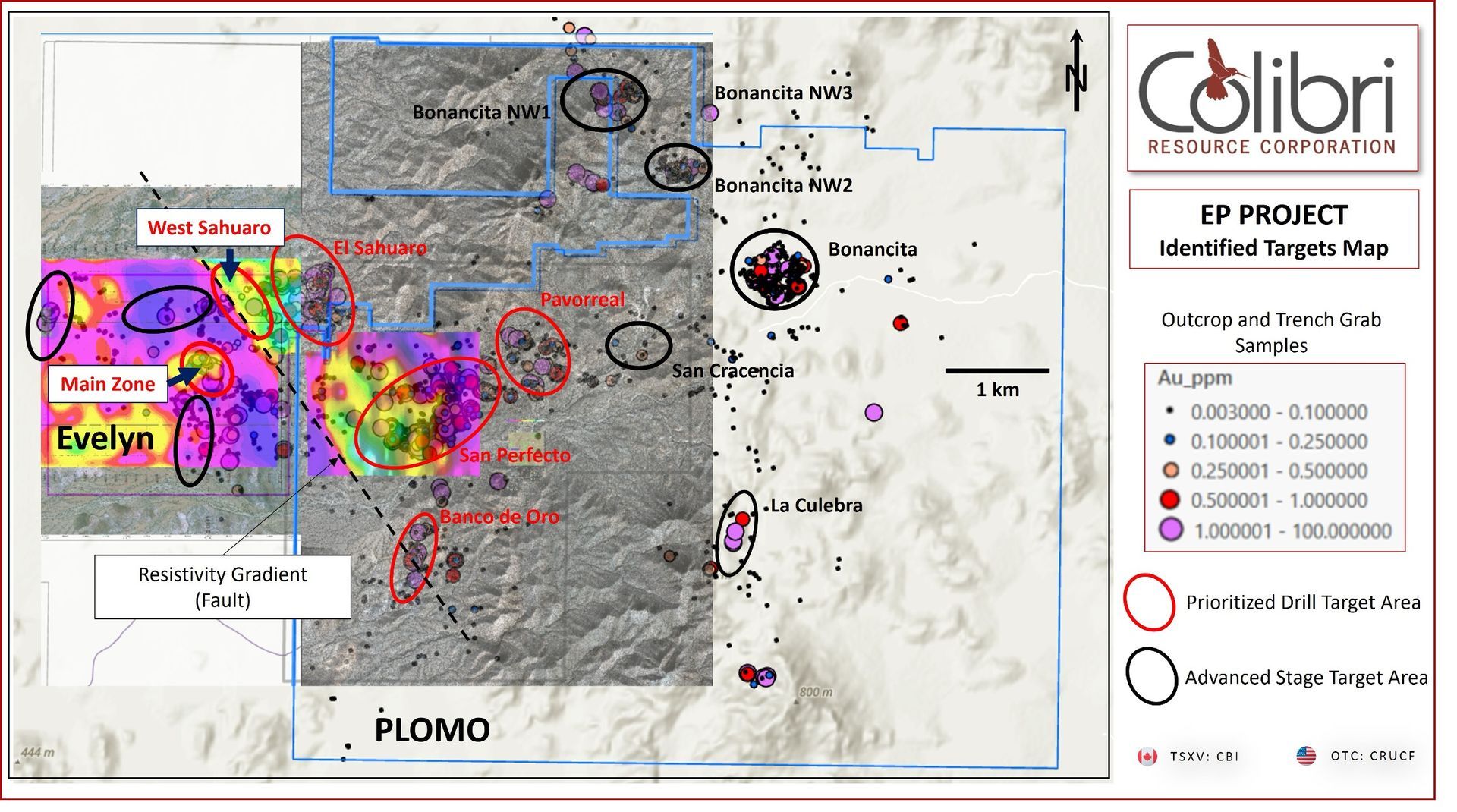

The West Sahuaro drill target was prioritized based on a coherent Au in soil anomaly that trends north northwesterly over approximately 500 m length. The Au soil anomaly is spatially associated with a similarly oriented north northwesterly structure that has been derived from geological mapping as well as IP resistivity interpretation. The interpretation of said steep resistivity gradient extends through the IP data sets to the southeast of Evelyn and onto the Plomo property over a total distance of approximately 2.5 km (Figure 3). The trend of the resistivity gradient, when projected approximately 1 km further to the southeast, intersects Banco de Oro, a historical small scale Au mine which is a prioritized target for the Company. The Company is evaluating the significance of the north-northwest trending structure and West Sahuaro mineralization spatial association and anticipates further testing of this setting across the Evelyn and Plomo properties.

Main Zone Area Drilling

A total of 1,436 m was drilled at the Main Zone. Three separate targets were tested (see figure 4):

- The northern extension of interpreted east dipping mineralization lenses:

Three holes were drilled in a westerly trending drill fence to test the northern projection of moderately easterly dipping lenses of Main Zone mineralization. Hole EVE23-190 and 191 collared to the east and planned to test the deeper extension of mineralization were both terminated due to ground conditions above target depth. Both holes intersected anomalous to low grade mineralization above target depth and both holes ended in mineralization. Hole EVE23-192 successfully intersected 3 zones of mineralization consistent with the up-dip projection of previously interpreted mineralization. Intersected mineralization is reported in table 2. - The intersection of interpreted (under alluvium cover) structures coincident with a geochemical anomaly derived from a previously reported short-hole drill program:

Holes EVE23-193, 194, and 195 were drilled to test this target which is located 100 m north of the Main Zone drilling. All holes intersected numerous narrow 1 to 2 m zones of Au > 0.1 g/t Au but failed to intersect the thicker zone characterizing the Main Zone. - The SGH anomaly south of the Main Zone:

Drill hole EVE23-186 was collared adjacent (footwall) to the Main Zone vein and planned for 300 m length to test the interpreted SGH anomaly and related structure at depth. The hole was terminated well above the target due to ground conditions at 137 m. EVE23-186 intersected consistently anomalous Au values from surface to a drill depth of 101 m. Assays and intercepts > 0.1 g/t Au are reported in table 2. Hole EVE23-202 was drilled to the south to intersect the SGH anomaly coincident with the previously interpreted (projected) structure. EVE23-202 intersected a zone containing vein quartz with disseminated pyrite over a 5 m interval from 173 m to 178 m all of which contained anomalous gold values including a high of 0.967 g/t Au over 1 m.

Table 2: Significant Assays from Main Zone Drilling

| Target | Hole ID | From | To | Length | Au g/t |

|---|---|---|---|---|---|

| Main Zone Ext. North | EVE23-190 | 8 | 9 | 1 | 0.27 |

| Main Zone Ext. North | EVE23-190 | 86 | 88 | 2 | 0.152 |

| Main Zone Ext. North | EVE23-191 | 16 | 24 | 8 | 0.122 |

| Main Zone Ext. North | EVE23-191 | 33 | 39 | 6 | 0.186 |

| Main Zone Ext. North | EVE23-192 | 4 | 14 | 10 | 0.242 |

| Main Zone Ext. North | EVE23-192 | 34 | 55 | 21 | 0.152 |

| Main Zone Ext. North | includes | 45 | 47 | 2 | 0.383 |

| Main Zone Ext. North | EVE23-192 | 86 | 88 | 2 | 0.144 |

| Geochem. Anomaly N | EVE23-193 | 55 | 56 | 1 | 0.111 |

| Geochem. Anomaly N | EVE23-193 | 69 | 71 | 2 | 0.186 |

| Geochem. Anomaly N | EVE23-193 | 75 | 76 | 1 | 0.151 |

| Geochem. Anomaly N | EVE23-193 | 94 | 95 | 1 | 0.194 |

| Geochem. Anomaly N | EVE23-193 | 110 | 112 | 2 | 0.12 |

| Geochem. Anomaly N | EVE23-194 | 43 | 44 | 1 | 0.119 |

| Geochem. Anomaly N | EVE23-194 | 53 | 54 | 1 | 0.12 |

| Geochem. Anomaly N | EVE23-194 | 56 | 57 | 1 | 0.121 |

| Geochem. Anomaly N | EVE23-194 | 107 | 108 | 1 | 0.351 |

| Geochem. Anomaly N | EVE23-195 | 3 | 4 | 1 | 0.119 |

| Geochem. Anomaly N | EVE23-195 | 85 | 86 | 1 | 0.137 |

| Geochem. Anomaly N | EVE23-195 | 103 | 104 | 1 | 0.13 |

| SGH | EVE23-186 | 1 | 3 | 2 | 0.174 |

| SGH | EVE23-186 | 35 | 37 | 2 | 0.116 |

| SGH | EVE23-186 | 78 | 80 | 2 | 0.346 |

| SGH | EVE23-187 | NSA | |||

| SGH | EVE23-188 | NSA | |||

| SGH | EVE23-189 | NSA | |||

| SGH | EVE23-202 | 173 | 174 | 1 | 0.967 |

About Main Zone

The Main Zone is the most advanced target on the Evelyn property. It is interpreted as a series of north-northeasterly striking and moderately east dipping lenses occurring over an approximate strike length of 250 m and previously drilled to a vertical depth of approximately 120 m. Mineralization exposed on surface and in historical mine workings consists of a north-northeast striking and moderately easterly dipping quartz vein that is discontinuously exposed over a strike length of approximately 120 m. The quartz vein pinches and swells along the strike length on surface reaching a maximum exposed thickness of approximately 1.5 m. Grab samples from surface exposures of the vein have returned assay values of 43.9 g/t Au and 40.1 g/t Au. Previous drilling has intersected similarly high-grade mineralization and includes 12.19 g/t Au over an intersection length of 3 m. Mineralization in both the hangingwall and footwall of the Main Zone vein includes multiple quartz vein intersections and low to locally moderate grade Au assay values in chlorite-carbonate-pyrite altered host rocks. Longer mineralized intercepts of veined and altered host rock comprising the easterly dipping lenses at the Main Zone include:

- 87 m at an average grade of 0.13 g/t Au including an interval of 8 m at 0.34 g/t Au

- 86 m at an average grade of 0.17 g/t Au including an interval of 10 m at 0.55 g/t Au

- 34.7 m at an average grade of 0.28 g/t Au including 5.65 m at 1.0 g/t Au

- 29.0 m at an average grade of 0.47 g/t Au including 6.0 m at 0.97 g/t Au

South of the exposed Main Zone vein, the north-northeast trending structure is interpreted to extend under colluvium cover. To explore the southern extension of the Main Zone, the Company completed a Soil Gas Hydrocarbon (“SGH”) survey which resulted in a well-defined anomaly.

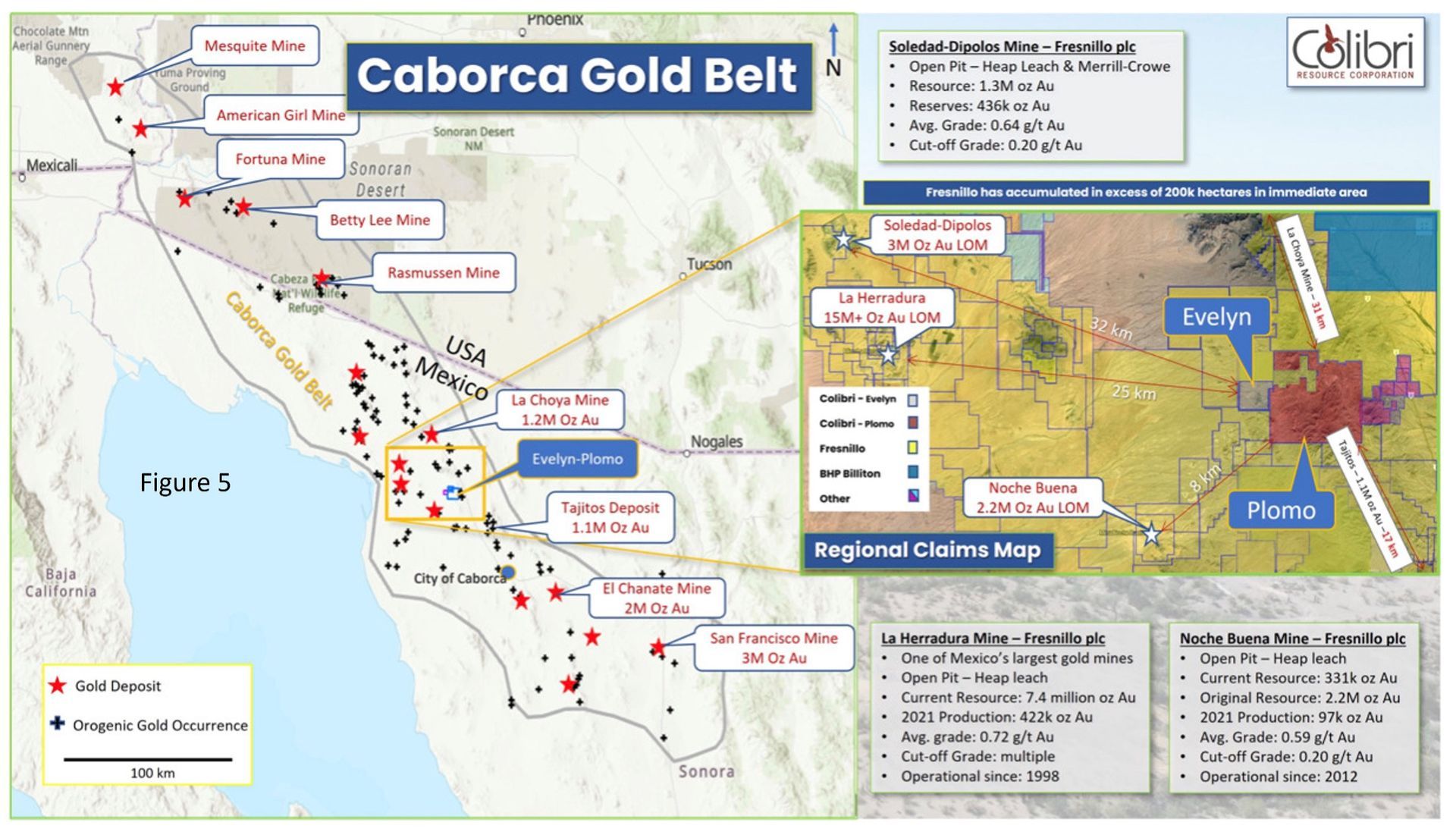

About the EP Project and Next Steps

The EP Gold Project is located within the Caborca Gold Belt (“CGB”) of northwestern Sonora and is comprised of the Evelyn and the Plomo properties covering a total of 4,766 hectares (“Ha”). The northwest trending CGB is approximately 500 km in length and is characterized by a number of orogenic-type gold deposits, prospects, and occurrences including the > 15 million ounce La Herradura Mine, located 25 km west of EP, the > 2-million-ounce Noche Buena Mine located approximately 8 km southwest of EP, and the past producing Soledad-Dipolos Mine (> 3 Moz Au) located approximately 32 km to the northwest of EP (see figure 5).

The Evelyn property was acquired by the Company in 2012 and the acquisition of the Plomo property was completed in March of 2023. On the Evelyn property, Colibri has completed comprehensive surface exploration including soil sampling, geological mapping and outcrop sampling, an airborne magnetic survey, and a property wide induced polarization survey. Since February 2020, Colibri has drilled a total of 12,333 metres (total of reverse circulation and core drilling) and is advancing mineralized zones at the Main Zone, El Sahuaro, and the newly discovered West Sahuaro. On the Plomo property, the Company has compiled historical exploration data and has completed its first exploration program which included geological mapping and outcrop sampling at selected target areas on the property.

The Company is continuing to advance its EP project-wide interpretation and exploration model and has identified 14 target areas (see figure 6) with recent and historical work that includes high grade grab samples from outcrop, high grade grab and channel samples from historical mine working, and drill intercepts that are both locally high grade and are consistent with grades being mined in the Caborca Gold Belt. Current work includes interpretation and inclusion of the drill results reported here and the prioritization of future drill targets. To support this work, the Company will complete an airborne (drone) magnetic survey over a selected part of the Plomo property in January 2024 and will be completing detailed geological mapping on selected targets and areas of the EP Project.

QUALIFIED PERSON

Jamie Lavigne, P. Geo and a Director for Colibri is a Qualified Person as defined in NI 43-101 and has reviewed and approved the technical information in this press release.

ABOUT COLIBRI RESOURCE CORPORATION:

Colibri is a Canadian-based mineral exploration company listed on the TSX-V (CBI) and is focused on acquiring and exploring prospective gold & silver properties in Mexico. The Company holds six high potential precious metal projects, all of which have planned exploration programs for calendar 2023.

For more information about all Company projects please visit: www.colibriresource.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Notice Regarding Forward-Looking Statements:

This news release contains "forward-looking statements". Statements in this press release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future. Actual results could differ from those projected in any forward-looking statements due to numerous factors. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Although the Company believes that the plans, expectations and intentions contained in this press release are reasonable, there can be no assurance that they will prove to be accurate.

For information contact:

Ian McGavney

President, CEO and Director

Tel: (506) 383-4274,

Related news releases.