NEWS RELEASE - Dieppe, NB., March 16, 2023 - Colibri Resource Corporation (TSX.V:CBI) (OTC:CRUCF) ("Colibri" or the "Company") is very pleased announce the strategic acquisition of the “Plomo Gold” property located in the Caborca Gold Belt, northwest Sonora, Mexico.

HIGHLIGHTS INCLUDE:

- The Plomo property covers an area of approximately 4,260 hectares (“Ha”) and is contiguous with the Company’s Evelyn Property. The additional land increases Colibri’s footprint by 842% to a total of 4,766 hectares.

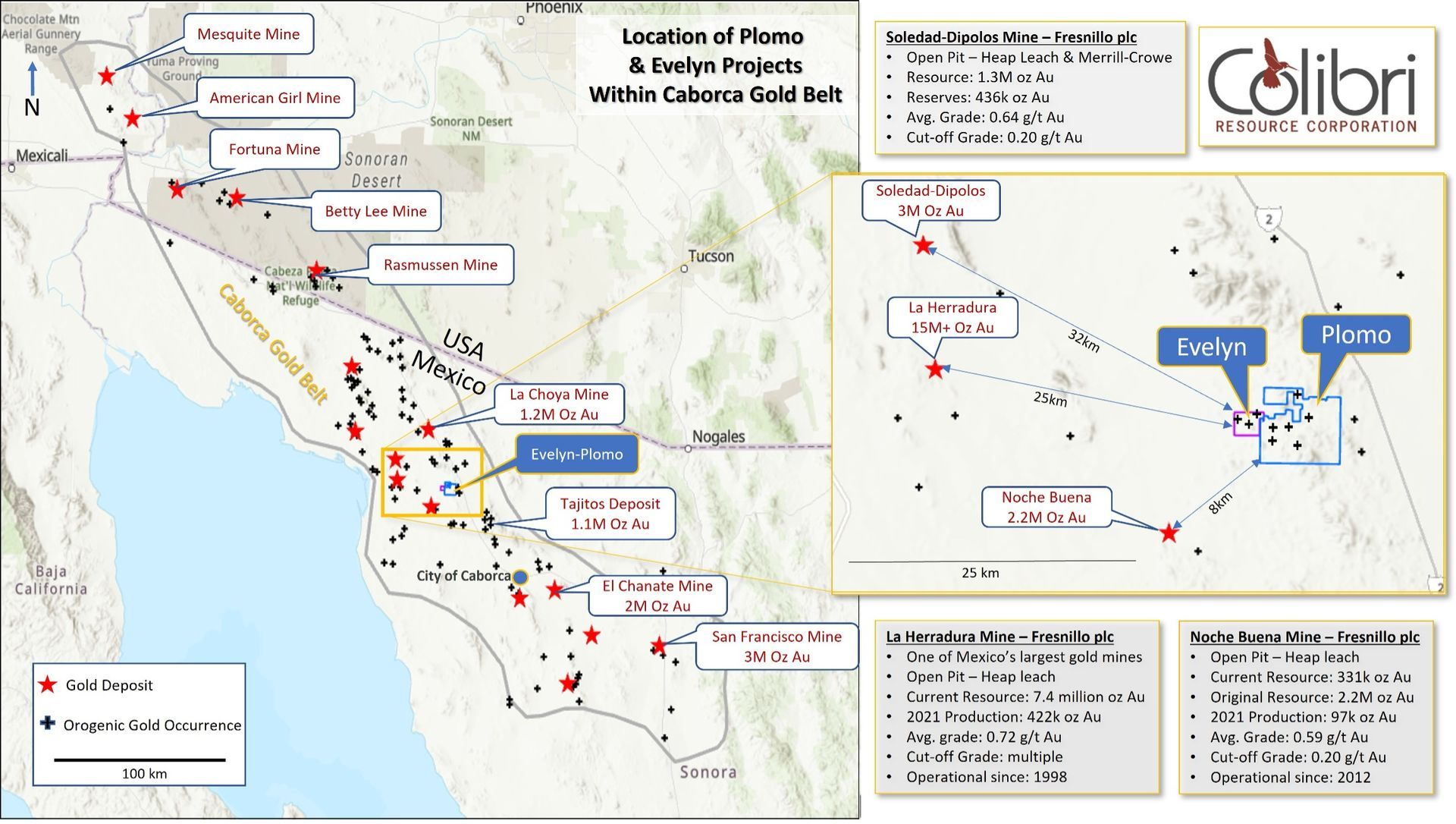

- The Plomo and Evelyn properties are located in the 500 km long, northwest trending Caborca Gold belt which includes the > 15 million ounce La Herradura Mine, located 30 km west of Plomo and the > 2 million ounce Noche Buena Mine located approximately 8 km southwest of Plomo.

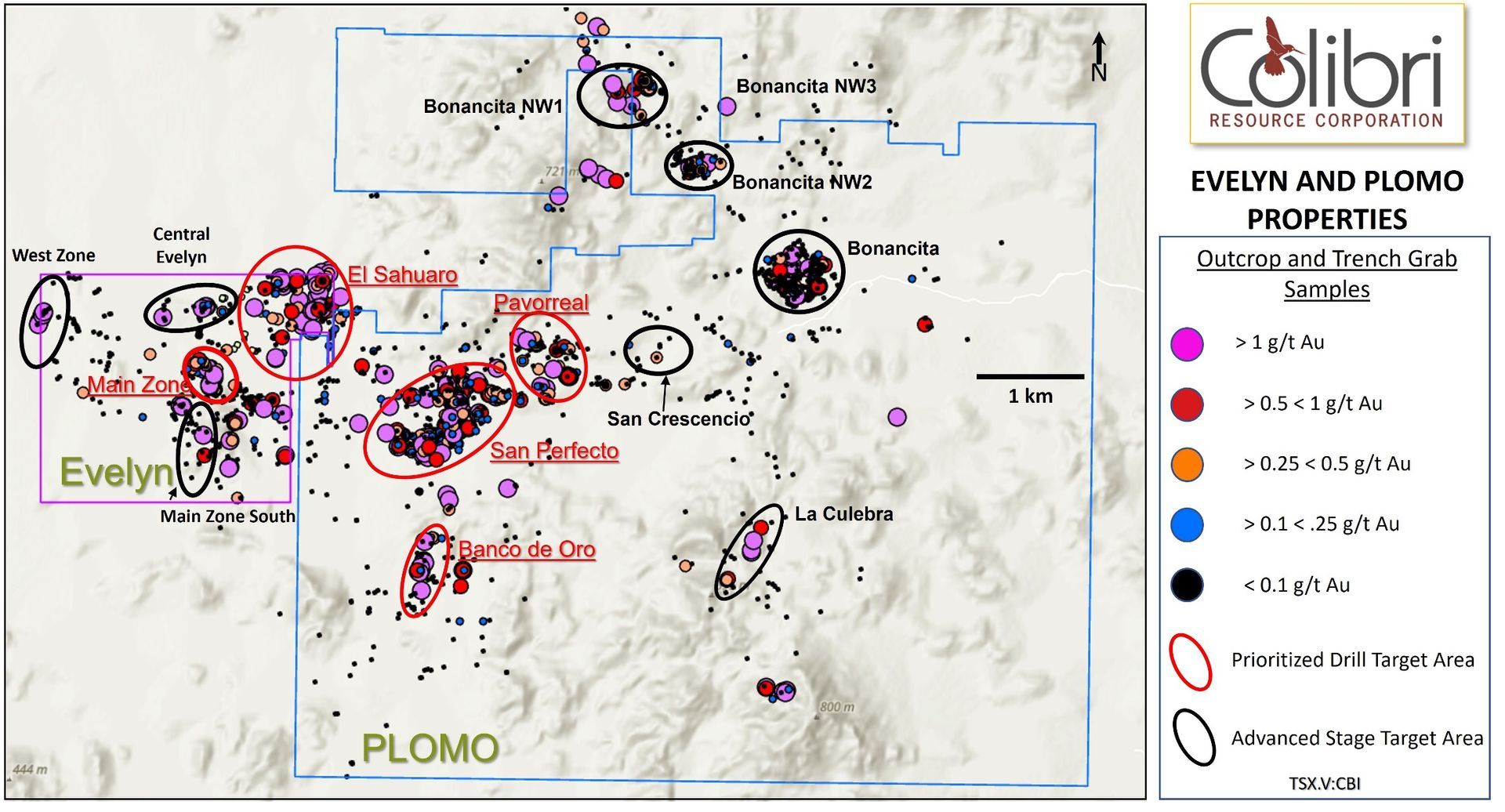

- The current (historical) database totalling 1,853 surface rock samples includes 524 samples greater than 0.1 grams per tonne (“g/t”) Au, 132 samples greater than 1.0 g/t Au, and 15 high grade samples greater than 10 g/t Au. Surface exploration including prospecting, mapping, and rock sampling since 2007 has resulted in the identification of 9 target areas on the Plomo property.

- Underground sampling completed in the adit at the Banco de Oro prospect in 2008 are reported to have included 298.0 g/t Au over a chip length of 2.4 metres

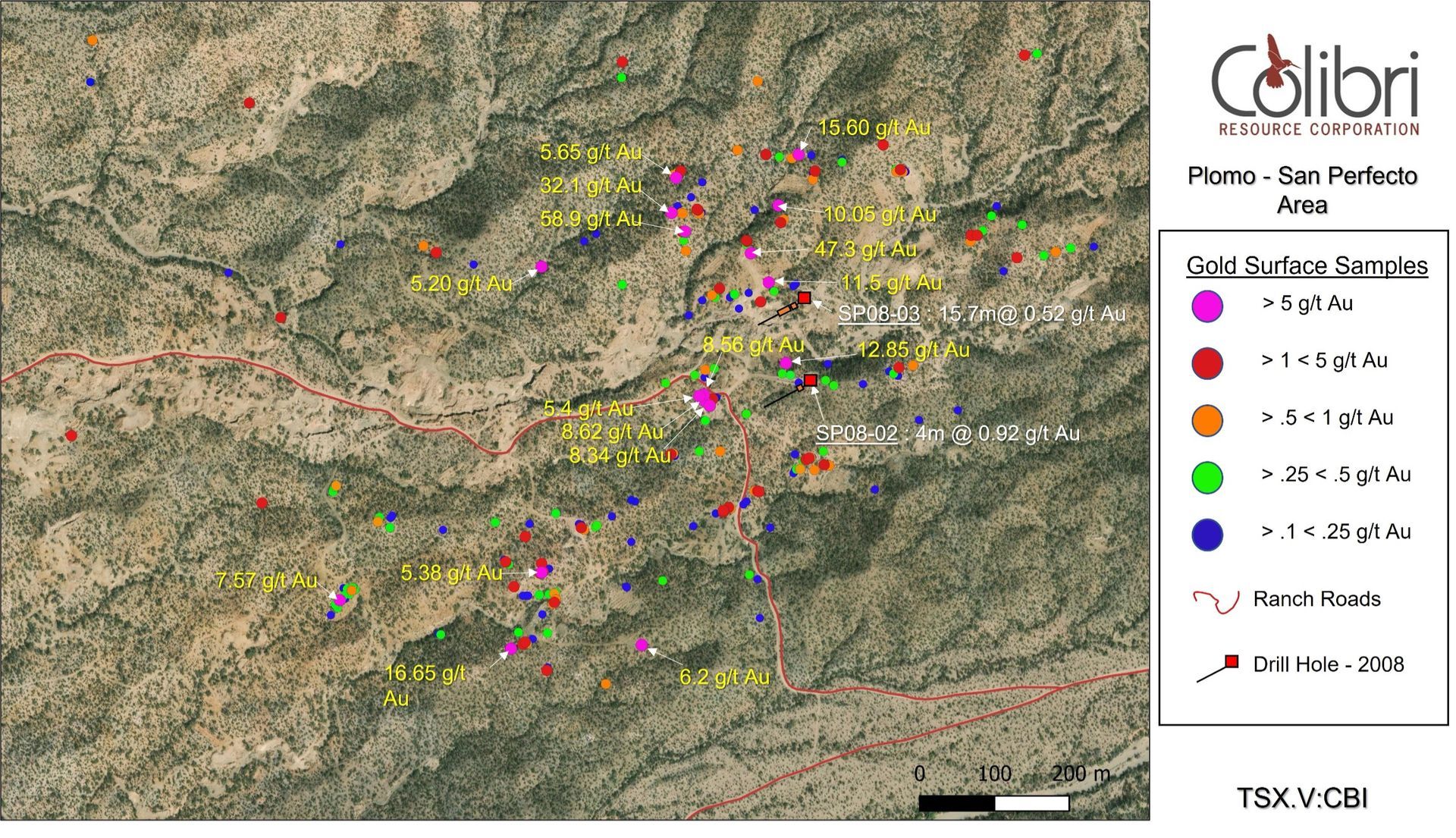

- The Plomo property has been the subject of only very limited exploration drilling, completed in 2008, with a total of 1,570 meters completed in 10 holes. A highlight of the drilling is the intercept of 0.66 g/t Au over an intersection length of 11.65 metres (“m”) completed in the San Perfect target area.

- The Plomo property has had small scale artisanal mining including, pits, adits, and placer mining dating back to the 18th century. First recorded exploration was in 2006 and the property has been the subject of only episodic exploration since that time.

- Due diligence mapping and sampling completed by Colibri geologists has confirmed vein style mineralization consisting of veins, veinlets, and vein stockworks, altered host rocks that include intense silicification, sericite, disseminated pyrite, and locally tourmaline bearing stockworks and breccias.

- Compilation and due diligence related field work completed by Colibri has provided the foundation for continued exploration planning which includes the prioritization of drill targets on the newly combined Evelyn-Plomo property, the planning and execution of field exploration programs to advance targets to the drill stage, and property scale surveys to completely evaluate and realize the property potential.

Ron Goguen, President & CEO of Colibri commented, “Plomo is a great addition to our property portfolio in Sonora. We have been very encouraged with the progress made on our Evelyn property over the last 18 months and the acquisition of Plomo provides us with a much expanded footprint for discovery. Our technical due diligence on the Plomo property confirmed significant continuity of alteration and structure especially in the San Perfecto target area and most significantly confirms the application of our exploration model developed to date through our work at Evelyn”.

Plomo Location and Geological Setting

The Plomo Gold property is located in northwestern Sonora, approximately 50 kilometres (“km”) northwest of the town of Caborca (Map 1). The Plomo property consists of 2 exploration concessions covering an area of 4,260 Ha located immediately to the east of the Company’s Evelyn property. The Plomo property is located within the Caborca Gold belt which consists of vein, replacement, and disseminated styles of Au mineralization interpreted as Orogenic type gold mineralization emplaced during the Laramide Orogeny. Major deposits currently or recently in production include La Herradura, San Francisco-Llano, El Chante, Soledad-Dipolos, and Noche Buena (see map 1). The Caborca Gold belt remains a very active exploration district with development projects occurring at Tajitos (920,000 Oz Au Indicated Resource and 173 Oz Au Inferred Resource).

Plomo Historical Exploration and Results

The Plomo property has been the object of historical, very small scale mining activity consisting of test pits and adits and likely minor gold production thought to date back to the 18th century. It appears that modern exploration and evaluation of Plomo was initiated with geological mapping and sampling in 2006 with the collection and analyses of several hundred out crop samples. Mapping, sampling, and assaying of outcrop grab samples was completed in 2007 and 2008 also with the collection and analyses of several hundred samples. Diamond drilling was completed on the Plomo property during 2008 with the completion of 10 holes totalling 1,570 m. The next recorded exploration on the property was 2012 with the further collection of outcrop samples and mapping and during this time geological mapping completed to date was compiled. The next phase of work recorded was completed in 2021 and consisted of further geological mapping and sampling as well as 14.1 line kilometres of Induced Polarization (“IP”) survey which borders the eastern boundary with Evelyn.

The field work completed on the Plomo property since 2006 has resulted in the collection of a large number of high grade outcrop samples (Figure 2). A total of 1,853 surface rock samples includes 424 samples greater than 0.1 grams per tonne (“g/t”) Au, 132 samples greater than 1.0 g/t Au, and 15 high grade samples greater than 10 g/t Au. The sampling has resulted in the identification of 9 prospect areas on the Plomo property (Figure 2).

Colibri has completed compilation of historical exploration data and information and has completed due diligence field work. Based on this work, Colibri has prioritized targets for continued exploration on the Plomo property.

Highlights include:

- The Banco de Oro prospect area occurs over an area of approximately 1,000m x 450m which includes a narrow south-southeast striking and shallow west dipping open cut developed on surface over an approximately 70 m strike length. The extent of underground development is unknown to the Company. Numerous historical surface grab samples > 1 g/t, including 5 samples > 5 g/t Au, from Banco de Oro form a north-northeast trend over an approximately 1 km distance. Historical sampling of the fault zone exposed in the open cut at surface and underground returned 298.0g/t Au over 2.35 metres, 15.1g/t Au over 0.65 metres, 14.5g/t Au over 0.80 metres and 11.0g/t Au over 0.60 metres. Mineralization at Banco de Oro consists of brecciated quartz veins hosted in foliated sericitized rhyolite and is interpreted to be at the intersection northwest trending and northeast trending fault zones. The Banco de Oro is a priority target area with the objective of developing a drill plan.

- The San Perfecto target includes numerous grab samples with Au > 1 g/t occurring over a over a NE-SW trend length of approximately 950 m and a NW-SE trend length of approximately 700m and includes several samples > 5 g/t Au (see Figures 2 and 3). The San Perfecto area is the target of recent alluvium placer mining and contains several older pits of uncertain age. Due diligence field work by the Company confirms that the area is underlain by well developed and continuous zones of quartz-sericite-hematite+/- pyrite alteration and is characterized by numerous faults and shears zones trending both NE and NW. Two drill holes have been completed in the San Perfecto target area one of which which intersected 0.66 g/t Au over 11.65 m. The San Perfecto area is coincident on a NW trend with the Company’s Sahuaro target on the Evelyn property. The San Perfecto is a priority target area with the objective of developing a drill plan. As a priority, the Company will also be evaluating structural controls and the potential continuity of the San Perfecto and the Evelyn’s Sahuaro zone along a NW trending structural domain.

- The Pavorreal target is located NE of the San Perfecto target area and similarly contains zones of pervasive quartz-sericite-hematite-pyrite alteration. However, historical work also recognizes tourmaline alteration including tourmaline in NW trending structures reported to be traced over a 600 m strike length and containing anomalous gold values including 5.82 g/t Au. Due diligence mapping by the Company confirms the presence of tourmaline-quartz alteration locally forming overprinting stock work and breccia textures. Preliminary observations by the Company indicate that the quartz-sericite-pyrite + tourmaline alteration is hosted, at least in part, by granodiorite. The Pavorreal is a priority target area to complete advanced geological mapping and sampling with the objective of advancing the target to the drill stage.

- The Bonancita target area is located in the north-central part of the property northeast of the San Perfecto and Pavorreal targets and consists of 4 prospect areas; Bonancita, and Bonancita NW1, NW2, and NW3. Historical work in the Bonancita target area notes very strong NW trending foliation development. The extent and significance of the foliated zone remains unknown to the Company. However, the Company notes that three of the occurrences, Bonancita, and Bonancita NW1, and NW2, which all contain historical grab samples greater than 1 g/t Au, form a well defined NW trending linear. Compilation by the Company confirms that the alignment of the 3 prospects, is coincident with both a strong topographic lineament and with a strong, NW trending, regional scale magnetic gradient lineament. Recent exploration reports on Plomo have recommended drilling at both the Bonancita NW1 and NW2 prospects. Colibri views the Bonancita target area as an earlier stage opportunity to evaluate the potential for a large gold system through geological mapping and possibly geophysics to support future drill hole planning.

Plomo Geology and Mineralization

The Plomo property is underlain by a variety of rock types that include Paleoproterozoic metamorphic rocks, a sequence of Jurassic volcanic rocks ranging in composition from andesite to rhyolite, and intrusive rocks that include diorite, granodiorite, and monzonite. Based on the Company’s due diligence data compilation and field work, and correlation with mapping completed on the Evelyn property, Colibri interprets the intrusive rocks to be part of both the Jurassic volcanic-sedimentary sequence and the subsequent Cretaceous/Paleocene Laramide tectonic-magmatic event.

Structures previously mapped on the Plomo property trend dominantly northwest-southeast and to a lesser extent to the northeast-southwest. These fault and shear zone orientations are recognized as a regional control on the occurrence and distribution of gold mineralization in the Caborca Gold belt. Through compilation, evaluation of available geophysical data sets, and field due diligence work, Colibri correlates faults and structural domains mapped on the Evelyn property onto the Plomo property. Preliminary evaluation of geophysical data sets suggests that a major NNW-SSE trending structure, mapped and also interpreted from resistivity data, on the Evelyn property is continuous on the southwestern Plomo property.

Gold mineralization on the Plomo property consists of quartz veins, veinlets, and stockworks with disseminated pyrite, oxidized pyrite associated with dominantly quartz-sericite-hematite-pyrite alteration. Anomalous gold values from historical work are also associated with quartz-pyrite-tourmaline bearing alteration assemblages. Colibri’s due diligence field work confirmed the presence of historically sampled gold mineralization to be hosted by multiple rock types including andesite, diorite, granodiorite, and rhyolite.

Ian McGavney, COO of Colibri commented, “The Plomo property, like our Evelyn property, has a great address. It contains all the ingredients that characterize large gold deposits in the Caborca Gold Belt and contains targets we consider to be drill ready. We are of the opinion that while Plomo been the object of very well executed surface exploration programs that have advanced very promising prospects, it has not yet seen a sustained and systematic approach to exploration. Minimal drilling has been completed and it was completed very early on in the exploration history of the property without the benefit of recent work. However, we are of the opinion that the work completed to date provides an excellent framework for continued exploration and combined with our Evelyn property provides over 4,776 Ha from which to prioritize drill programs and ground exploration programs”

Plomo and Evelyn Next Steps

The compilation and due diligence field work completed in the acquisition phase provides an excellent start to exploring Plomo. The review has provided the Company a much greater understanding of the high quality targets on the Plomo property. The Company is continuing its geo-compilation with the objective of completing a seamless dataset across the Evelyn-Plomo property and further developing its exploration model to include observations and data from Plomo.

The combined Evelyn-Plomo property provides Colibri with discovery opportunities that range from advanced (drill ready), intermediate, and early stage. The planned exploration strategy includes:

- Prioritization of drill targets

- Development of drill targets from existing prospects

- Property wide evaluation

Prioritization of drill ready targets: The combined property provides a number of high-quality drill targets. On the Evelyn side targets include the Main Zone and El Sahuaro. On the Plomo side, drill targets include Banco de Oro, San Perfecto, and the Pavorreal prospects. The Company will be evaluating these targets, deriving drill plans for each.

Development of additional drill targets: Current and planned exploration on the Evelyn property include ‘short hole’ drilling under alluvial cover immediately north of the Main Zone, evaluation of the Central Evelyn prospect, evaluation of a potentially major structure mapped and interpreted from a very strong resistivity gradient, and evaluation and drill testing a very well defined soil anomaly. On the Plomo property, the compilation completed to date points to the Bonancita target area and potentially related large NW trending structure as an area for continued exploration to develop a drill target.

Property Wide Evaluation: A near term priority for Colibri is the completion of a seamless (GIS) compilation of all Evelyn and Plomo geology, geophysics, and geochemistry. In addition to other possible initiatives, the Company anticipates completing a high resolution airborne magnetic survey over the Plomo property, similar to that completed at Evelyn in 2021, completing property wide geological mapping, and completing a property wide soil geochemistry survey. The Company is of the opinion that this work will support the interpretation of drill ready and advanced targets as well as providing the opportunity for early stage discovery.

QUALIFIED PERSON

Jamie Lavigne, P. Geo and a Director for Colibri is a Qualified Person as defined in NI 43-101 and has reviewed and approved the technical information in this press release.

ABOUT COLIBRI RESOURCE CORPORATION:

Colibri is a Canadian-based mineral exploration company listed on the TSX-V (CBI) and is focused on acquiring and exploring prospective gold & silver properties in Mexico. The Company holds seven high potential precious metal projects of which five have planned exploration programs for calendar 2023.

For more information about all Company projects please visit: www.colibriresource.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Notice Regarding Forward-Looking Statements:

This news release contains "forward-looking statements". Statements in this press release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations, or intentions regarding the future. Actual results could differ from those projected in any forward-looking statements due to numerous factors. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Although the Company believes that the plans, expectations and intentions contained in this press release are reasonable, there can be no assurance that they will prove to be accurate.

For information contact:

Ronald J. Goguen

President, Chairperson and Director

Tel: (506) 383-4274,

Related news releases.