News

Colibri Resource Corporation To Acquire Yaque Minerales From Ontop Capital Limited

October 30, 2018

DIEPPE, N.B., October 30, 2018. (CBI: TSX-V) Colibri Resource Corporation (“Colibri”) is pleased to announce that it has entered into a share purchase agreement dated October 27, 2018 with OnTop Capital Limited (“OnTop”) to purchase 100% of the issued and outstanding shares of Yaque Minerales S.A. de C.V (“Yaque”), a wholly owned subsidiary of OnTop (the “Transaction”). Closing of the Transaction is subject to regulatory and shareholder approval.

As consideration for the Transaction, Colibri has agreed to issue a convertible debenture in the amount of $1 million CDN bearing an annual interest rate of 2.5% which is convertible at any time, in whole or in part, over the next 5 years into common shares of Colibri at $0.20 per share for a total of up to 5 million shares. There will be no finders’ fees payable.

Under Multilateral Instrument 61-101 Protection of Minority Shareholders in Special Transactions (“MI 61-101”), the Transaction is a “related party transaction” as OnTop is a “related party” to Colibri by virtue of certain common share ownership and management personnel. Specifically: (a) John Schiavi, a control person of OnTop, is also a control person of Colibri as he owns or controls, directly and indirectly, greater than 20% of the issued and outstanding common shares of Colibri; and (b) Ron Goguen, a director, officer and 10% shareholder of OnTop, is also a director, officer and shareholder of Colibri. Normally, under MI 61-101, an issuer is required to obtain a formal valuation and seek minority shareholder approval for a related party transaction. Colibri will be seeking minority shareholder approval but will not be obtaining a formal valuation as Colibri’s securities are listed on the TSXV which is not a specified market and, as such, Colibri is exempt from this requirement.

The independent members of the Board of Directors for Colibri, Paul Bartos, Roger Doucet, Ed Stringer, Jacques Monette, and William MacDonald, consider the acquisition cost of these properties to be fair and reasonable. The independent members reviewed all known information generated to date (financial records & geological/exploration data). In addition, they received a satisfactory report from a qualified independent director of Colibri who spent time on site in Mexico. Data generated to date also includes an independent NI-43 101 compliant report on El Mezquite which was prepared in 2016. It is felt that these properties line up with Colibri’s stated objectives which are to acquire and explore highly prospective gold projects in Mexico which have indications of historical exploration and mining activity.

Colibri Chief Operating Officer Ian McGavney said “There is limited downside risk for the shareholders in this proposed transaction. The deal structure allows Colibri to secure these properties for the next 5 years using little cash resources which allows monies to be used for exploration activities. We see the conversion price of the convertible debenture as very positive considering the current share price level.”

Further details of the Transaction will be provided in a management information circular to be issued in connection with a special shareholder’s meeting to be called to approve the Transaction. A further news release will be issued when a meeting date has been set.

About Yaque Minerales S.A. de C.V

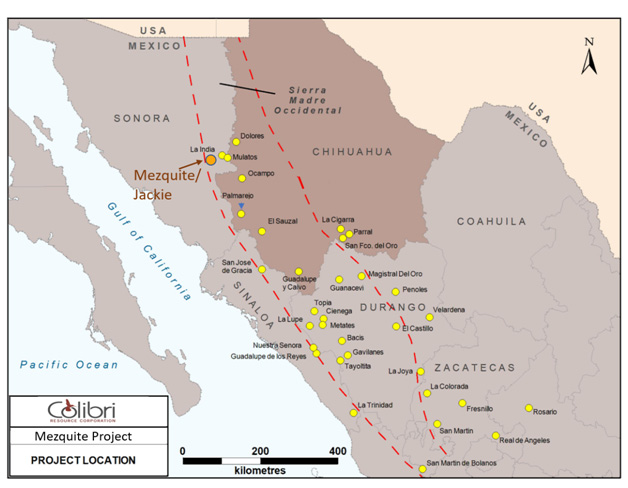

The assets of Yaque consists of two mineral exploration properties located within the major “Sonora Gold Belt” of northern Mexico. The projects are located between the La Colorada Gold, La India, and Mulatos Gold Mines.

The first mineral exploration property named the El Mezquite Gold Project is considered to be highly prospective and is 180 hectares in size. It is being acquired for its potential to be a low grade / large tonnage gold project. The second property is the 1130 hectare “Jackie” project which is approximately 2 km south of the El Mezquite. Both projects are un-drilled but have showings of old workings. Yaque owns 65% of the Mezquite property with an option to acquire the remaining 35% for US$265,000 with payment commencing in 2020 and payable in equal instalments over 5 years. If Yaque does not exercise this option, its interest will remain at 65%. The Mezquite property is subject to a 1% Net Smelter Royalty from production in favour of the original vendors which can be purchased at any time for $500,000 USD.

The second property is the 1130 hectare “Jackie” project which is approximately 2 km south of the El Mezquite. The project borders to the east of Minera Alamos’ (TSX Venture – MAI) “open-pit heap-leach development project” called “Santana”. (TSXV-MAI: News release: Oct.25, 2018). Yaque owns the Jackie project 100%, with no underlying royalties.

El Mezquite Gold Project

The El Mezquite Project is located within the west-central portion of the Sierra Madre Volcanic Complex in eastern Sonora. The entrance of the concession is easily accessible from the paved Mexican Highway #16 and contains 1 km southerly trending dirt road which runs through the middle of the known gold mineralization. Exploration work on the property to date has consisted of chip sampling and a Magnetic / 3D IP survey on the eastern portion of the property. There is no evidence of historic drilling on the project.

Assay results from 321 rock chip samples taken from the property indicate that 42 of the samples report values of gold >0.1 ppm, averaging 0.74 ppm of Au and 25.7 ppm Ag. These 42 samples are distributed along an area that extends for 600 m in north-south direction by 300 m east-west. The highest values reported are 3.41 ppm Au and 198 ppm Ag.

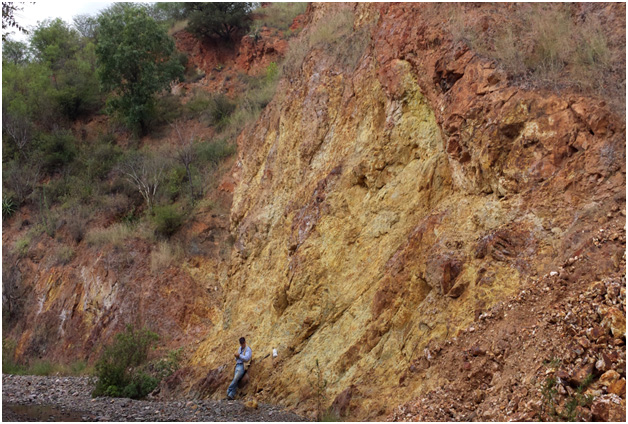

El Mezquite contains a broad alteration zone that extends for about 2 km in north/south direction, by 1 km east/west width. Within the broad alteration zone are at least four colourful (after oxidizied sulfides) hydrothermally altered contact zones about a silicified feldspar porphyry. The distinct gold and silver values and geophysical anomalies reported in the El Mezquite area are mostly associated with these zones of sulphide alteration.

There is evidence of previous mine workings on the property. There are 4 shallow workings on the WNW side of the El Mezquite Concession which require follow up exploration work and there is also a 2 meter X 2.1 meter adit drifting 35 meters westerly from the main dry river. The adit first drifts 29 meters to the west at 270ᵒ and then bends to 240ᵒ heading for another 6 meters. It is open and in fair shape.

“Jackie” Gold Project

The project is 1130 Ha in size and is located approximately 2 km south of the El Mezquite. Very little work has been done in the way of exploration on this property at this point. However, several old workings have been noted on the property. This project is 100% owned by Yaque and is not subject to any royalties.

The project borders the “Santana” project actively being explored by Minera Alamos (TSXV-MAI) to the east. Minera Alamos has announced that it has successfully completed a pre-commercial bulk sample/heap leach test on this project and in October 2018 has announced additional exploration drilling results of: 95.7m @ 1.57 g/t AuEq, 80.4m @1.05 g/t Au, and 95.5m @0.65 g/t Au respectively from its Phase 1 program.

Additional information on both projects will be made available at: www.colibriresource.com

Jackie E. Stephens, P. Geo for Colibri is a Qualified Person as defined in NI 43-101 and has reviewed and approved the technical information in this press release.

About Colibri Resource Corporation:

Colibri is a Canadian mineral exploration company listed on the TSX-V (CBI) focused on acquiring and exploring properties in Mexico.

For Further Information Please Contact:

Ronald J. Goguen, President, Chairperson and Director

Tel: (506) 383-4274

moc.ecruoserirbiloc@neugognor

The TSX Venture Exchange has neither approved nor disapproved the contents of this news release.Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. The statements made in this news release may contain forward-looking statements that may involve a number of risks and uncertainties. Actual events or results could differ materially from the Company’s expectations and projections.

Illustration #1: (Property Location in the Sierra Madre Occidental)